FBM assisted in the restructuring, relaunch and refinancing of a metalworking company

Background

Concerns a medium-sized metalworking company that has grown rapidly in recent years by winning various orders. This growth of activities made the entrepreneur aware that expansion of the company’s premises was necessary. The subsequently drawn up plans for complete new construction of the company premises could be quickly realized with thanks to the house banker and subsidizing agencies. This was also a good time to immediately renew the entire machine park. Nothing more stood in the way of a successful future.

Unfortunately, almost as soon as the new building was completed, the economic malaise hit the company full force. The brand new machinery was virtually unused when the company’s first customers reported that they could no longer pay. After all, the new machines had to pay for themselves. The price tag for the same activities had to go up. More and more existing customers dropped out. The order book shrank to an unprecedented low level. There were too many overqualified personnel on the shop floor.

Sales and earnings plunged 50% within a year. Not only the entrepreneur, but financiers began to worry.

Solution FBM

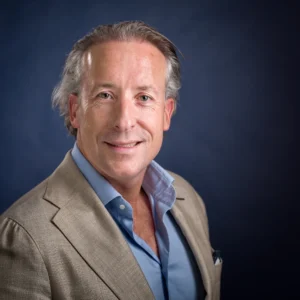

FBM was called in for assistance. After a thorough, but also quick, analysis of the situation, FBM quickly knew what the entrepreneur needed and how the company could climb out of the doldrums.

The entrepreneur was faced with the challenge of making the multi-million dollar investments in his company pay off in a market that had completely collapsed. The action plan included concrete actions in four areas: revenue, organization, costs and liquidity.

- Turnover: enter new markets and bring in customers through smart and targeted actions. However, these cost time. And there really wasn’t any time given the dire situation the company was in.

- Organization: the internal and legal organization also appeared to have much to improve. These necessary adjustments also took more time than still available.

- Costs: substantial cost savings were found to be possible in almost all areas. Some savings could be realized quickly. Other savings, on the other hand, only occurred after regular termination of existing contracts.

- Liquidity: much effort was made to quickly restore the liquidity situation. First, to bring in arrears from major customers. However, most efforts went into a combination of proposals to suppliers and financiers with the objective of achieving a rapid debt reduction. After all, financing charges were weighing disproportionately on the company. Despite the fact that the majority of suppliers and financiers were willing to cooperate in debt restructuring, it was the credit insurers who put a spanner in the works.

For the company, that left it with no choice but to make a controlled relaunch with the help of FBM.

Result

As a result of the intensive restructuring phase, it ultimately took the entrepreneur relatively little effort to realize this relaunch. The plans drawn up by FBM were already fully ready. Together with the entrepreneur, finding investors for a completely reorganized company proved to be no problem at all. The restart proposals from the investor combination thus created to the trustee were therefore most likely to succeed. Suppliers, customers and financiers were extremely happy with this successful restart.