Entrepreneur community

Welcome to the FBM Corporate Finance entrepreneurial community. In our daily practice we meet many entrepreneurs with similar interests and challenges. We like to bring these driven entrepreneurs together to network, exchange knowledge and ideas and explore new investment opportunities.

Our community offers a unique network and access to experts and private equity, for example. Whether you are looking for strategic partners, inspiration for your next project, or investment opportunities, with us you will find an environment where entrepreneurs strengthen each other and create success together. Join us and help build and enrich your network and knowledge!

Meetings

Networking event Sept. 26

Together entrepreneur & investing

Meet our community

Assess whether private equity is right for you

Participate in our FBM Altix fund

Actively participate in community events

Grow your wealth

Investing in Private Equity

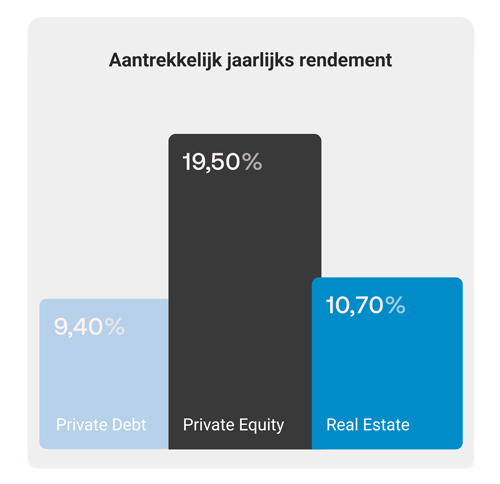

Together with Private Equity specialist Altix, we offer our entrepreneurial community the opportunity to invest in Private Equity. A market previously unavailable to the private investor. Private Equity is historically one of the highest-yielding investment classes, but traditionally only accessible to institutional investors and very wealthy individuals. Through our partnership with Altix, we are breaking that.

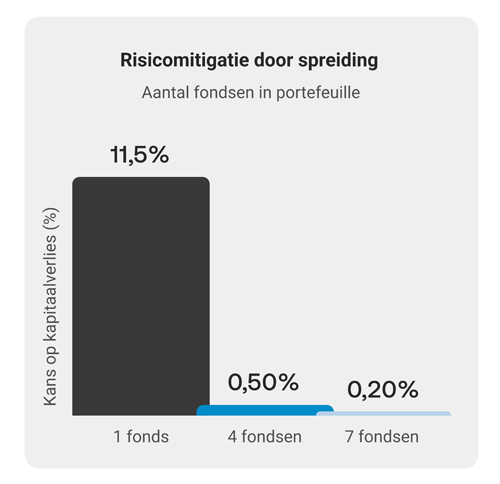

Private Equity (PE) funds invest in companies that are not publicly traded on stock exchanges. PE funds take an equity stake and/or provide capital to companies with the goal of creating value and generating long-term returns. While private equity investments may involve higher risks, they also offer attractive benefits to investors who are willing to accept these risks.

Some of the benefits of investing in private equity are:

- Higher Returns: Private equity investments have historically often produced higher returns than traditional public market investments.

- Longer Investment Term: Private equity investments tend to have longer investment horizons, which means investors should be willing to tie up their money for longer.

- Active Involvement: Private equity investors often have the opportunity to be actively involved in the companies they invest in.

- Diversification: Adding private equity to an investment portfolio can help diversify risk.

Please contact us for more information.

Brochure: FBM Alt.1 Fund

Through FBM Alt. 1 2023 fund, our relations get access to the best and most exclusive Private Equity funds. FBM can advise you further and tell you more about risk tolerance and investment objectives. The minimum deposit for participation in FBM Alt. 1 2023 is 100,000 Euro. For more information, request the brochure or contact Michiel Dullaert.

Download

Contact

- Rond het Fort 42

- 3439 MK Nieuwegein

- info@fbm.nl

- +31 (0)30 - 605 12 22

Blogs

We have again been nominated as acquisition firm of the year!

Annually, acquisition platforms Brookz and Dealsuite present the Merger & Acquisition Awards. Acquisition firms, investment firms and advisors are competing for the honor of winning one of the awards. We were proud to receive the award “best acquisition office in the medium category” in 2023 🏆. And this year we

What is market consolidation?

To consolidate literally means to merge. Market consolidation occurs when companies merge through mergers and acquisitions, reducing the total number of players in the market. Consolidating sectors with small and medium sized businesses include: Wholesale trade, IT market, Installation industry, Mechanical engineering and the Greenery industry. Sectors where large companies

What is a buy-and-build strategy?

A company with a ‘Buy & build’ strategy is one that seeks to grow at an accelerated rate through acquisitions, often driven by a private equity party. Literally, then, “Buy & build” means “buy & build. Smaller companies are merged into a larger company. Often the basis is a scalable